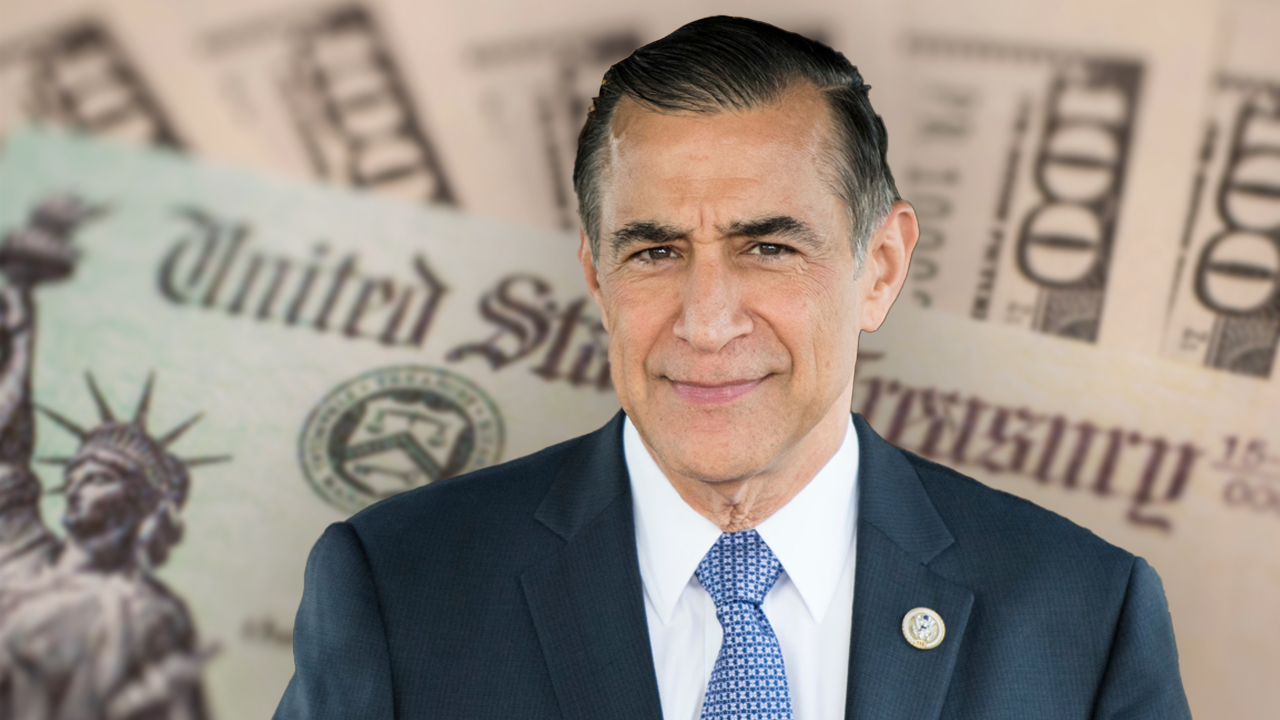

Darrell Issa Violates the STOCK Act with Delayed Treasury Bill Trades Disclosure

Representative Darrell Issa of California has recently come under scrutiny for violating the STOCK Act by failing to report a significant volume of Treasury bill trades on time. Issa disclosed seven separate trades amounting to up to $175 million in Treasury bills over a year late, with the oldest transaction occurring in February 2023. He reported these sales 580 days after the actual transactions, despite the STOCK Act’s requirement for U.S. Representatives to report trades within 45 days.

Details of Issa’s Treasury Bill Sales

Issa’s trades spanned various maturity dates throughout 2024 and were conducted through two separate investment accounts. The transactions, which included partial and complete sales, ranged in value from $1 million to $25 million. Sales from the first account occurred from January to April, while trades from the second account were made later in the year, involving Treasury bills due in June and August.

A Minor Fine for a Major Late Disclosure

Under the STOCK Act, the penalty for late disclosure is minimal—typically a $200 fine for first-time offenders. Considering that Issa’s delayed trades amount to as much as $175 million, this fine represents a negligible financial penalty for a significant violation of transparency rules.

Large Reporting Gaps Undermine STOCK Act’s Transparency

One notable issue with the STOCK Act is its range-based reporting system, which allows politicians to report trades in broad value brackets. For Issa, each of his trades was reported in the range of $5 million to $25 million, creating an enormous gap and limiting public insight into the actual financial activity. This method of reporting diminishes transparency, making it difficult to determine whether Issa’s total sales were closer to $35 million or $175 million.

Subscribe to our newsletter!

By submitting your email, you agree to our Terms of Service and Privacy Notice. You can opt out at any time.

Related Articles

Pelosi’s Timely Visa Stock Sale Before DOJ Lawsuit Raises Questions

Congressman Pete Sessions Invests in Microsoft and Nvidia Following Market Moves

Nancy Pelosi Reports Husband's $500K Investment in San Fran Commercial Property

Earl Blumenauer Increases Stake in NW Natural as Stock Rises Post-Purchase

Subscribe to our newsletter!

By submitting your email, you agree to our Terms of Service and Privacy Notice. You can opt out at any time.

By submitting your email, you agree to our Terms of Service and Privacy Notice. You can opt out at any time.